Leverage is something that forex traders use a lot in their activities. Many forex brokers offer leverage (up to 1:3000) and traders are able to use it to control large positions even when the capital isn’t too high. Leverage represents borrowed amounts of money that are meant to increase your initial capital’s purchasing power. Think of it as a loan that you give back to your broker once you close the position. Leverage in the finances has been used since around 1933. But when you’re new to forex trading, chances are you have no idea how to use leverage to your advantage. If you want to learn how to master it, don’t worry – this article will prepare you for using it when you’re trading forex.

1. Choose the Right Forex Broker

One cannot underestimate the power of choosing a forex broker, not when it has such a huge influence on the way your forex activity goes. Brokers come with their own regulations, as well as reputations and leverage options. You should always go with a broker with multiple leverage options available, as well as good customer support and quick withdrawals and deposits.

2. Think About Your Account Equity

Before you think about the right amount of leverage to use, you should think about how much equity your account has. Never go overboard by using the maximum leverage when your account has high equity. It can make you vulnerable as you’ll lose a lot of money. Instead, you should always use a smaller-balance account when you want to trade with higher leverage. The good news is that a lot of brokers have negative balance protection.

3. Learn How to Manage Risks

You don’t want to take too many risks, not when there’s so much at stake for you. Risking too much may end up with huge losses. This is why before you proceed with using leverage, you should have a strong risk management strategy in place.

There are different ways to go about this. Perhaps you could stop yourself from risking more than a certain amount on one trade or set stop-loss orders to prevent huge losses. Also, don’t forget to always check market conditions and change your risk parameters.

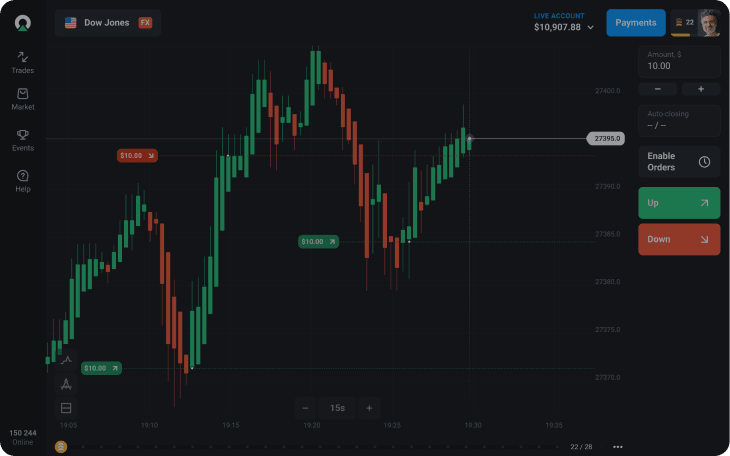

4. Take Advantage of Market Analysis

Another thing you should do is use analysis to your advantage. It’s crucial to understand where the market stands at that particular moment so you can make a proper and informed decision about when and where to use your leverage. This is how you will be able to find the best chances to apply your leverage and when not to use it in the first place.

Don’t refrain from gaining as much knowledge as you can. When you have a lot of data, it’s easier to use leverage, but also more effective.

5. Choose the Right Level of Leverage

You don’t have to use a certain leverage level just because someone else used the same one. How much leverage you use will affect the risks associated with it and influence the success of your strategy. Lower levels are better in the beginning, and as you become more experienced, you can simply increase the level. Make sure to figure out how comfortable you are too with certain amounts of leverage. If you ever feel like you’re stuck, just start with lower leverage ratios and you’ll be able to gain some experience.

Final Thoughts

Using leverage to your advantage can be challenging in the beginning. However, if you use the tips here, you should be able to do so more easily.

Also Read: Do You Own An Agribusiness? Here Are Some Useful Tips